Arranging a mortgage can seem like an endless process, full of paperwork. But there are ways to make it easier - get organised and make the most of your appointment with one of our mortgage advisors by following our handy checklist...

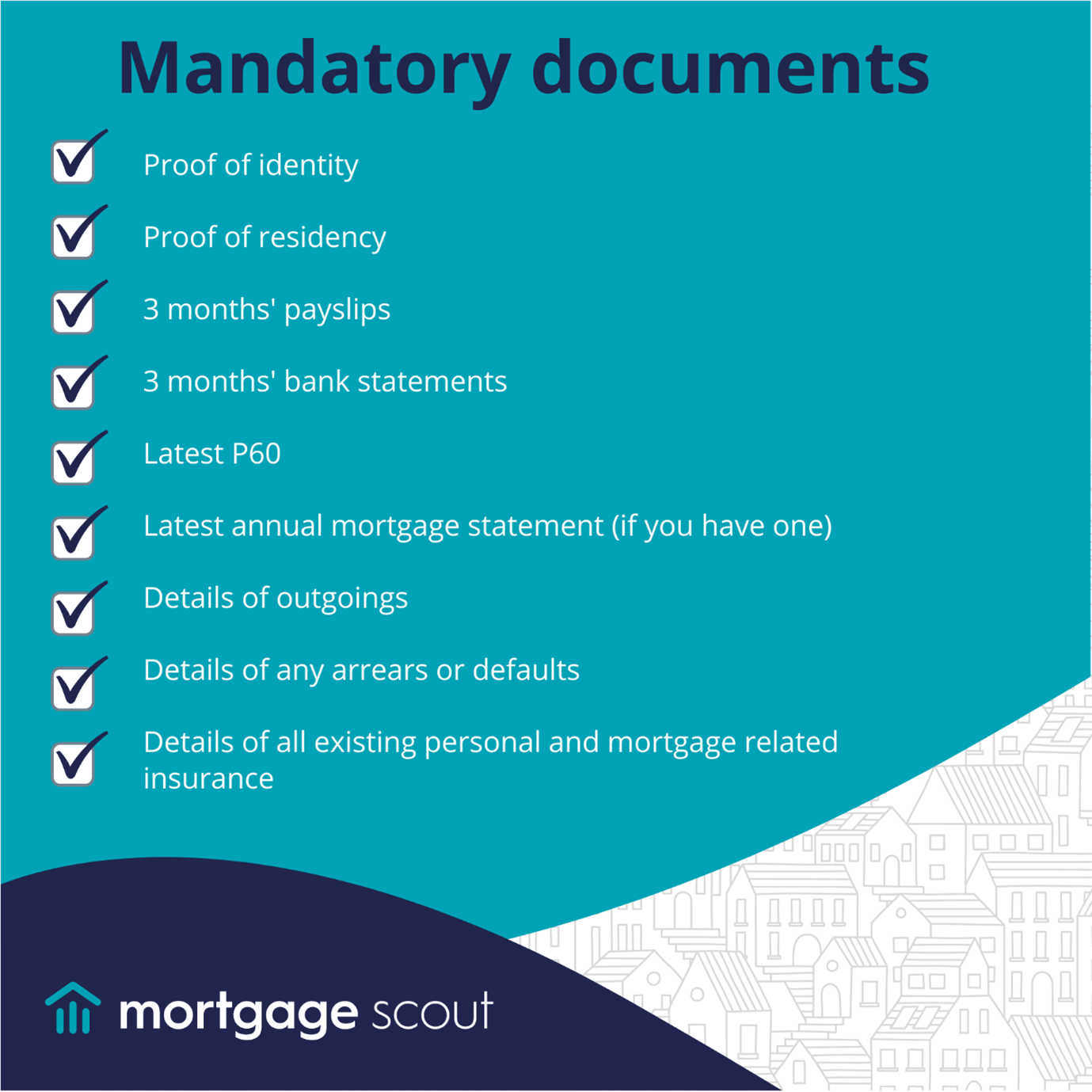

For our mortgage advisors to give you the best advice, they’ll need to see a number of important documents detailing your identity, address, and income. This way they can accurately calculate what you can afford to repay, over how long, and work out how much you can borrow from the bank or building society.

If you already have a property in mind, bringing the details of it along with proof of your deposit will help speed things up. Talking to a mortgage advisor signals to the other parties in your property chain that you are serious about moving, and this could help improve the chance of your offer being accepted.

After carefully reviewing all of your documents and understanding your current circumstances, your advisor will scout through mortgage deals from over 90+ lenders that we have access to, and recommend the most suitable mortgage deal for you.

Don’t worry if you forget all the information you’re given in the appointment, your advisor will write down exactly what they are recommending and why, so you have plenty of time to think it over!

Along with the recommended mortgage product, terms and repayments, your advisor will provide you with a quote and any insurance policies. The next steps are up to you. If you are happy with the quote – great! They will get the wheels into action and keep you updated through the process.

If you’re not happy with the quote, your advisor can work with you until they find the most suitable product. We’re here to support our customers, not lenders, and won’t settle until you’re happy.

Mortgage Scout has over 20 years’ experience matching buyers with mortgages. Whether you’re a first time buyer, a landlord wanting a buy-to-let, or you’re looking to re-mortgage, we can help. Get in touch to book a no-obligation appointment to discuss your requirements.

MAB 14637

You may have to pay an early repayment charge to your existing lender if you remortgage.

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances. The fee is up to 1%, but a typical fee is 0.3% of the amount borrowed.